Ditch the debit card and start earning some free travel by choosing the best no annual fee travel credit card for you! If you want to start making a little bit back on your normal everyday purchases and earn some free travel without the high annual fees, a no annual fee credit card is a great place to start!

Ditch the Debit Card for a No Annual Fee Travel Credit Card!

Every time you use a debit card over a decent intro credit card you are losing money. Most no annual fee travel or cashback cards will offer a 1-2% return on normal everyday purchases. While this isn’t as significant as some of the 5-6% returns that you will see on some of the more prestigious and expensive cards, 1-2% back shouldn’t be discounted.

Not only will you get a percentage return when using the right no annual fee card, you will also get a small welcome bonus and other rewards. For example, right now, the Hilton no annual fee card gives the cardholder a 70k welcome bonus and an annual free night certificate. Again, while this isn’t a massive bonus this isn’t insignificant, and coupled with the annual free night certificate just using this card alone could get you at least 2-3 free hotel stays a year.

Finding The Best No Annual Fee Travel Credit Card

No annual fee credit cards are a great starting place when considering reward travel. In full disclosure, they won’t give you thousands of dollars in free travel off the bat, and you won’t get the massive travel perks that come with the higher annual fee cards. However, you will start earning a small percentage back from your normal everyday purchases that you can put toward future travel! They are also an excellent way to start building credit if you are hoping to break into reward travel!

Here we’ve compiled the best no annual fee cards that are currently on the market, and given some examples of where you can stay and go with their current bonus offers!

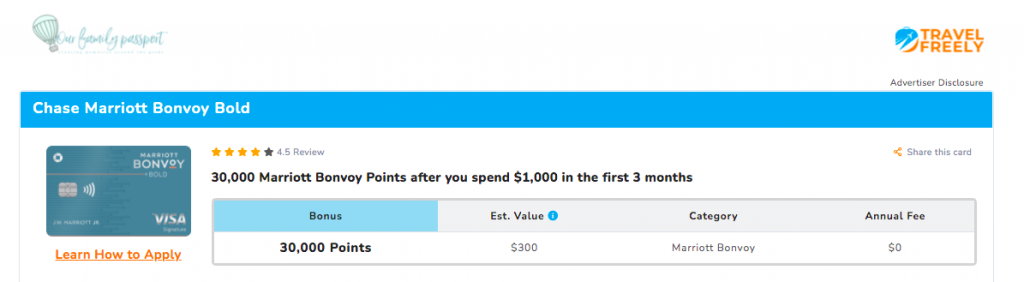

Chase Marriott Bonvoy Bold

This is an excellent beginner card for someone who enjoys Marriott hotels and stays at them often. While this Marriott card does not give an annual free night reward as the Hilton card does, Marriott points are worth a bit more.

- Annual Fee – 0

- 50k bonus points after spending $1000 on purchases in the first 3 months (this JUST went up to 50k points and is huge! It is usually 30k points so if you are thinking a Marriott card might be you I would give this a strong consideration!)

- 14x the points for every $1 spent at Marriott hotels

- 2x the points on all other travel purchases (airfare, rental cars, etc…)

- 1x the points on everything else

- Receive 15 elite night credits per calendar year qualifying you for silver elite Marriott status

Where can you stay with 30k Marriott points?

Head to Disneyland! Stay right near Disneyland at these Anaheim Marriott properties with 30k points or under per night for select dates. (Also, remember that right now the current promotion is 50k points instead of 30k!)

- Delta Anaheim Garden Grove

- Sheraton Garden Grove Anaheim Hotel

- Courtyard Anaheim Buena Park

- Springhill Suites Placentia Anaheim

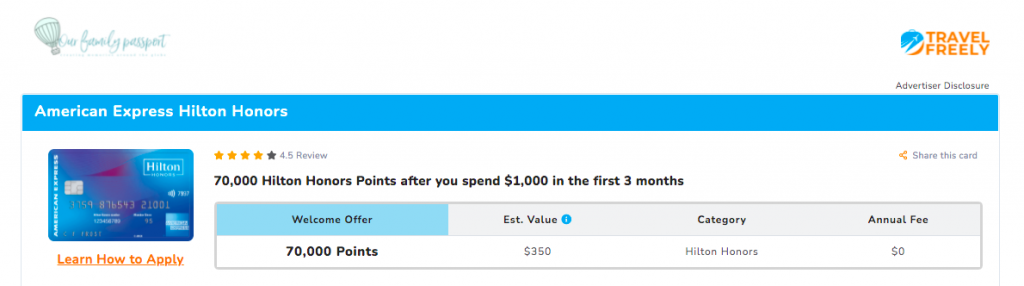

Hilton Honors American Express Card

This is one of the best no annual fee travel credit cards because it is one of the most generous. Even though Hilton points are not valued as high as some of the other points, a 70k intro bonus and an annual free night is a fantastic offer! Also, keep in mind that this card will give you 5x the points on groceries (not wholesale clubs), gas, and restaurants increasing your earning potential. This is a great intro card for anyone wanting a return on their normal purchases without having the annual fee.

- Annual Fee – 0

- 70k bonus points after spending $1000 on purchases in the first 3 months

- Free night annual reward stay

- 7x the points for every $1 spent at Hilton hotels

- 5x the points for purchases at US restaurants, supermarkets, and gas stations

- 3x the points for all other purchases

Where can you stay with 70k Hilton Points?

Go to Hawaii! Several 4 star Hilton properties are 70k points or less for a night’s stay in Hawaii on select dates!

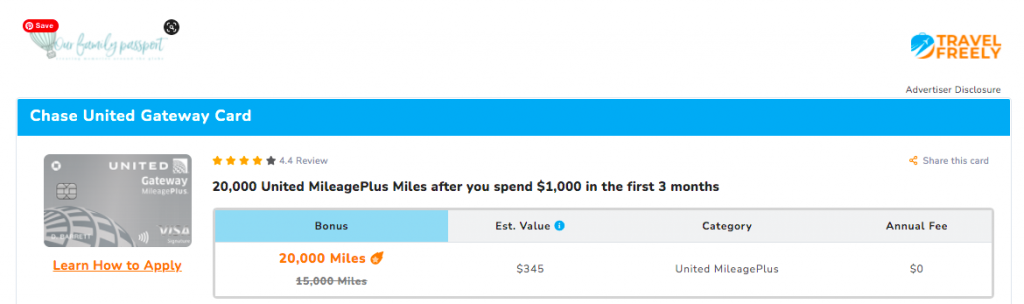

United Airlines Gateway Mileage Plus Card

A great card to consider if you fly United or if you live near a United hub. While the 20k bonus point offer is smaller than both the Marriott and Hilton offers, United points do not expire and if you are strategic in your booking 20k miles can get you several flights in the domestic US.

- Annual Fee – 0

- 20k bonus miles after spending $1000 in purchases in the first 3 months

- 2x the miles for every $1 spent on United purchases

- 2x the miles at gas stations

- 2x the miles on local transit and commuting (rideshare services like Uber, taxicabs, train tickets, tolls, subway cards, etc…)

- 1x the mile on all other purchases

- 25% back on United inflight purchases (not including tickets)

- No foreign transaction fees

Where you can currently fly with 20k United points

Visit the Miracle Mile in Chicago! Current flights on select dates from San Francisco to Chicago are 6.1k miles each way. Meaning you could fly round-trip from San Francisco to Chicago with another one-way trip to spare.

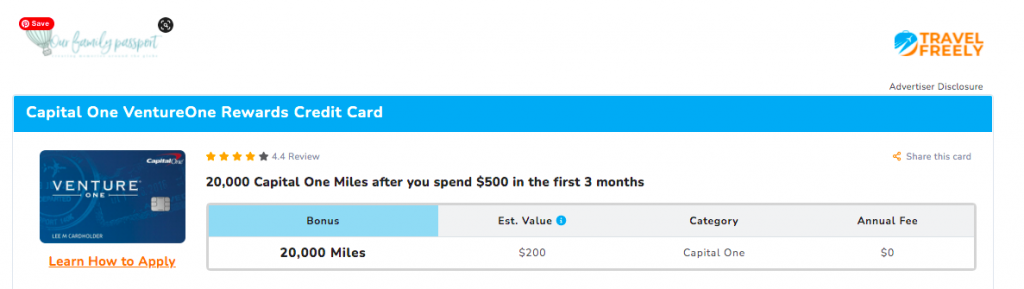

CapitalOne VentureOne Rewards

For those who like to use the CapitalOne portal and want to earn generic points that can be used on different hotel and airline partners, this is a decent intro card. You will get 5x the miles each time you book your hotel or rental car. However, this card DOES not give you any extra points other than the 1.25 per 1 dollar spent on flights or any other purchases. So that is something to consider. While this card is a decent starting option, in terms of rewards and earning potential you may want to consider one of the other cards.

- Annual Fee – 0

- 20k bonus miles after spending $500.00 in purchases in the first 3 months

- 5x the miles for every $1 spent on hotels and rental cars booked through Capital One Travel

- 1.25x the miles on all other purchases.

How much are 20k CapitalOne Miles worth?

20k CapitalOne Miles, when redeemed through the CapitalOne portal can be worth about $200.

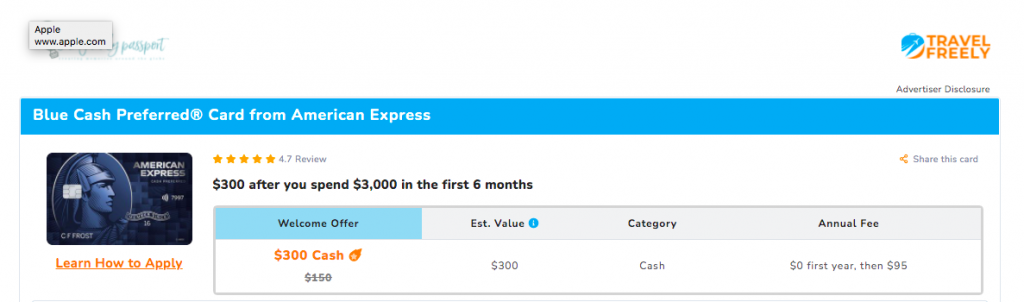

American Express Blue Cash Preferred

While this card is not technically a “travel card” and it only has a zero annual fee for the first year it should be a card that everyone who wants to earn something back on their average everyday spend should consider. The 6% back on groceries alone is significant and the $300.00 statement credit is awesome! I recommend this card for someone who is wanting to buy Disney tickets at a discount because you can buy Disney gift cards at your local supermarket, get the $300.00 statement credit and then also get the 6% cashback!

- Annual Fee – 0 the first year and $95.00 after that

- $350.00 back after spending $3,000.00 in purchases within the first six months

- 6% cashback for every $1 spent at U.S. Supermarkets (wholesale clubs like Costco don’t count)

- 6% cashback on select U.S. streaming services

- 3% cashback at U.S. gas stations, transit, train tickets, etc…

- 1% cashback on other purchases

How much could the Amex Blue Cash Preferred Card save you on Disney tickets?

Right now for a family of 4, standard theme park admission at Disneyland for 3 days is $1,280.00. If you apply the $300.00 credit toward your tickets and purchase your tickets with gift cards purchased at your supermarket and get the 6% cashback, you could save $376.80. Meaning your Disney tickets would cost $903.20 instead of $1,280.00.

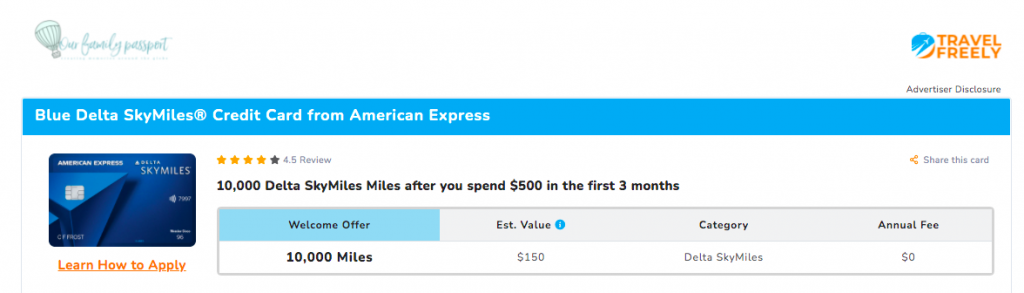

Delta SkyMiles Blue American Express

A great card to consider if you fly Delta or if you live near a Delta hub. While the 10k bonus point offer is smaller than the United offer, if you fly Delta often and are strategic in your booking, 10k miles can get you a free round trip flight in the domestic US.

- Annual Fee – 0

- 10k bonus miles after spending $500 in purchases in the first 3 months

- 2x the miles for every $1 spent on Delta purchases

- 2x the miles at restaurants

- 1x the mile on all other purchases

- 20% back on Delta inflight purchases (not including tickets)

- No foreign transaction fees

Where can you currently fly on 10k Skymiles?

Head to California! Right now at the time of writing on select dates, round trip flights from SLC to LAX and other U.S. cities are only 9k miles.

Select the Right No Annual Fee Travel Credit Card and Apply!

Most of these no annual fee travel credit cards require decent to good credit and can get you approved in minutes when you apply. If you want to stop leaving money at the counter each time you go to the grocery store or fill your car up with gas, then pick one of these cards, apply, and start earning that free travel now!

If you want more reward travel information you can check out this how to travel hack post here or sign up for a free email credit card consult here.

Let the free travel begin!

Cheers,

Kam

And as always, thank you so much for using my links! Doing so costs you nothing and helps me keep my recommendations and email consults free!